VAT (value-added tax) is a consumption tax applied to goods, services, and other taxable supplies across the European Union. A VAT invoice (tax invoice) is a document that has to be used if you or your customer are registered for VAT. A VAT invoice outlines the details of the products or services that are subject to a value-added tax.

If you have enrolled in Amazon’s VAT Calculation Service (VCS), an Amazon VAT invoice will be provided to your customers. However, if you do not use this service, or you need an invoice for a platform other than Amazon, you need to create one.

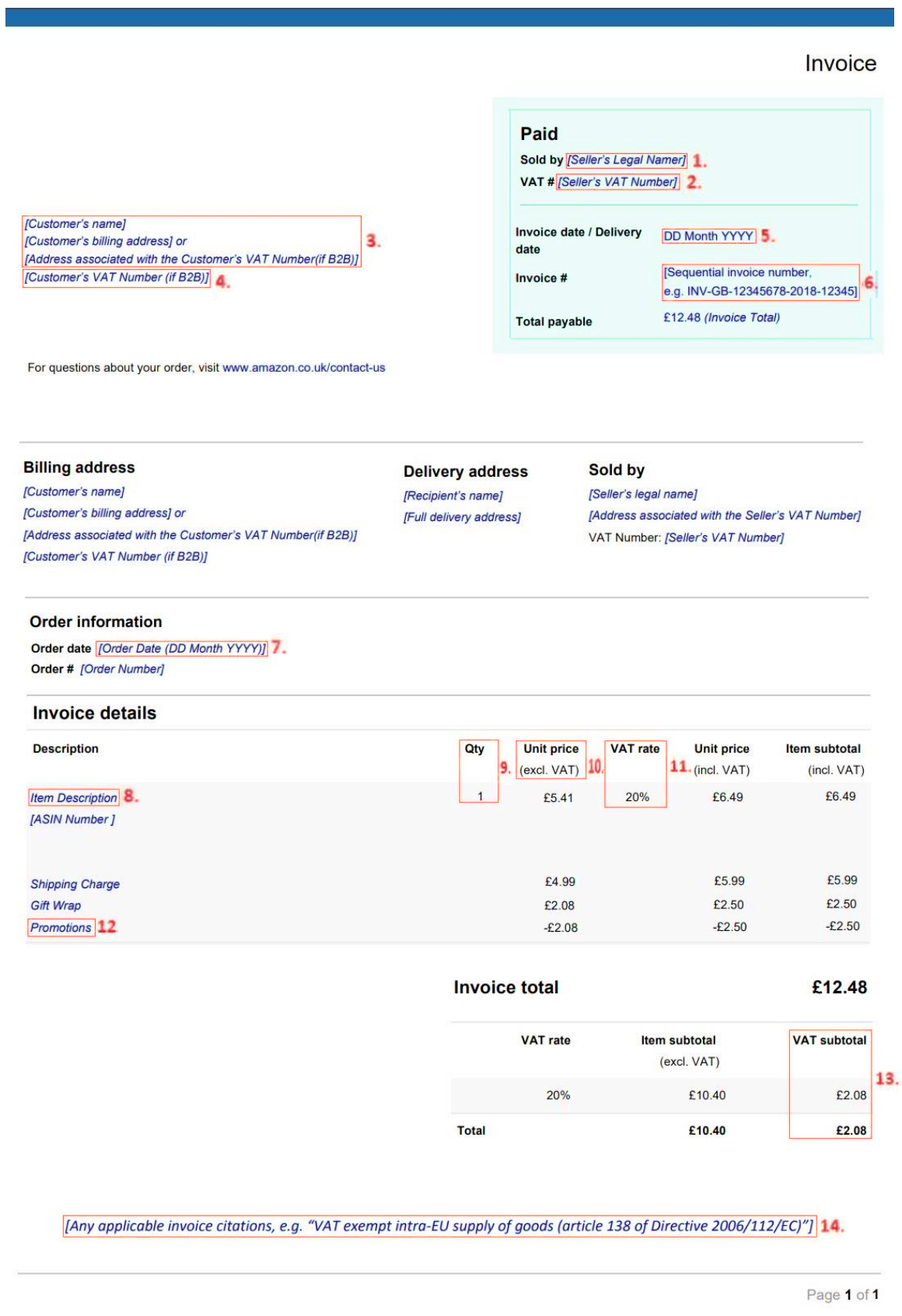

VAT Invoice Sample with explanations, based on Amazon’s guide

Download TCS_VAT_Invoice_Template_EN_v3.docx

(provided by Amazon invoice sample)

- Registered company name and address of the seller

- VAT identification number of the seller (if applicable)

- Complete official name and address of the customer

- VAT identification number of the customer

– Only necessary if the customer is responsible for the taxation of the purchase order (e.g., for intra-Community delivery, reverse charge procedure).

– Customer VAT Number is provided in VIDR. - Invoice date/service date

- Invoice number

- Order date

- Product name

- Purchase quantity

- The unit price of the item (without VAT)

- VAT rate applied

- Discounts/promotions, if not included in the unit price

- VAT amount

- Justification/references if the customer is responsible for the payment of VAT. Citation is a legal text used when the Customer owes VAT, in other words when the seller charges zero percent of VAT. This can happen in cases such as Domestic Reverse Charge, export out of EU, or intra-community supply of goods.