Walmart-funded incentives are automatically enabled in all Walmart seller accounts. However, eligibility for these incentives is determined solely by Walmart. Eligible products are enrolled in the program by default, but sellers have the option to manually unenroll specific products or disable the program entirely through their Walmart account settings.

How do Walmart-funded incentives work?

CAP program has been created by Walmart to ensure customers are offered competitive prices. If the price displayed on Walmart and charged to the customer is lower than the price submitted by the seller for the item, the seller receives the same payment for the item as if the item’s price was not adjusted.

For example:

- A seller sets the price of its eligible item at $50, with $5 shipping.

- The price displayed to the customer is $48 with $5 shipping, and the customer is charged $48, with $5 shipping.

- A seller receives payment for the sale as if the price charged and paid was $50 and $5 shipping.

How is it possible? Is Walmart losing on the transactions? The seller will receive the same overall net pay for a product after the Walmart referral fee calculation – as if the item’s price was not adjusted. In most cases, this means Walmart will just receive a small commission, but this will ensure them to keep the competitive pricing on the marketplace.

Opting Out of Walmart Incentives Program

If you want to remove your products from the Walmart Incentives Program, you can do so using one of two methods: manual unenrollment or bulk file upload.

- Manual Unenrollment

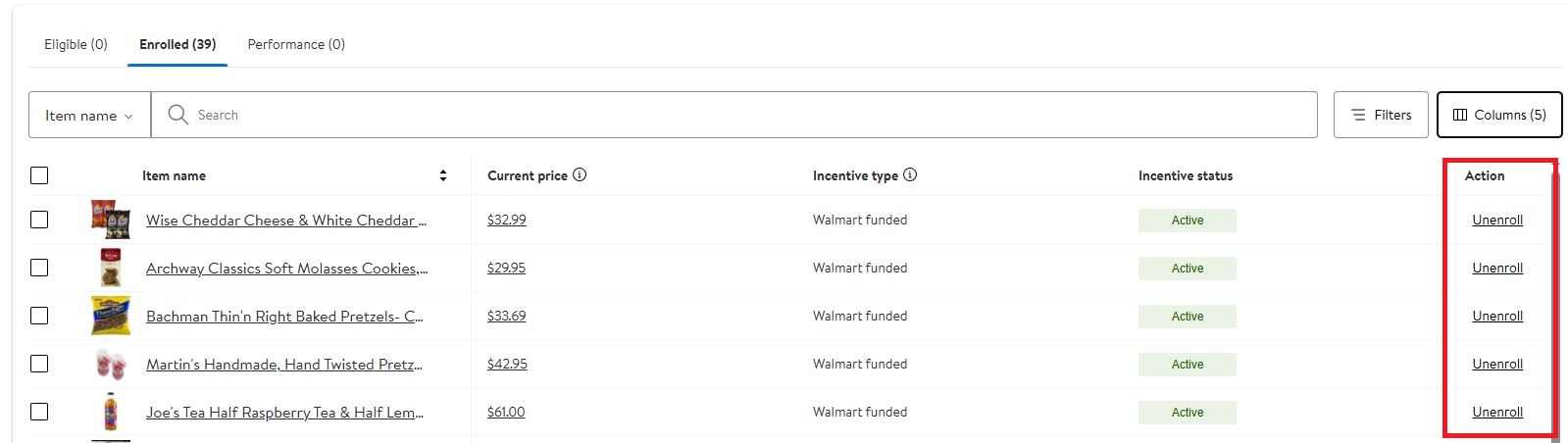

Go to Walmart Seller Center > Pricing > Incentives > Enrolled.

Locate the SKU you wish to remove and click Unenroll next to it.

- Bulk Unenrollment via File Upload

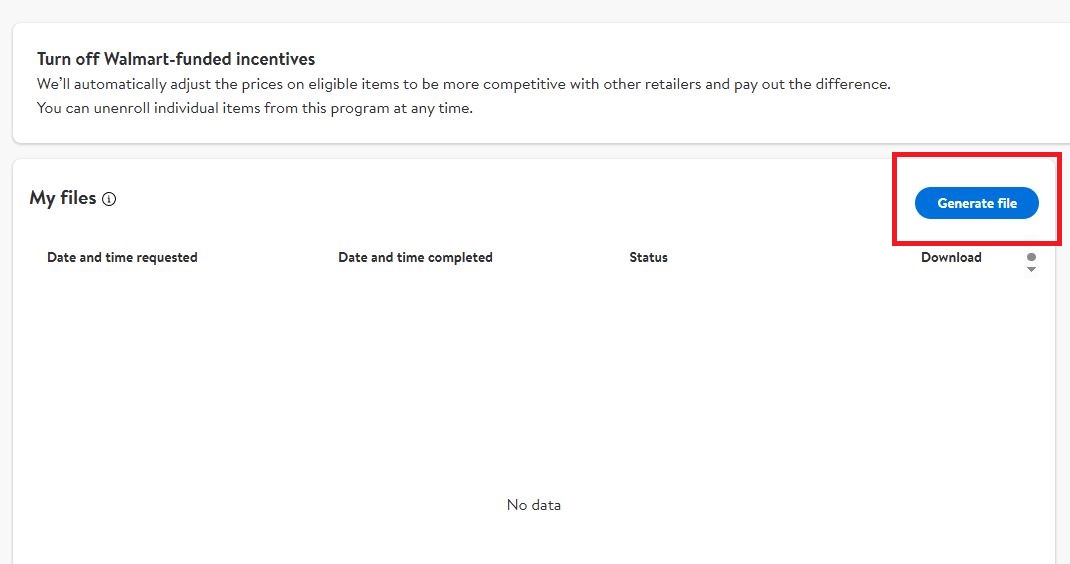

Go to Walmart Seller Center > Pricing > Incentives > Manage Incentives > Manage Walmart-funded incentives.

Click Generate file to download the incentives spreadsheet.

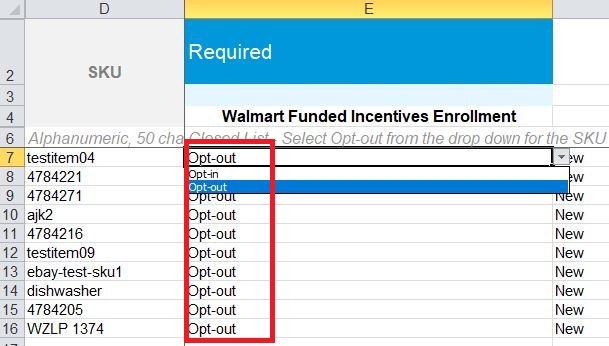

Open the file and find the Walmart Funded Incentives Enrollment column.

Set the value to Opt-out for each SKU you want to remove.

Save and upload the file back to the system

.

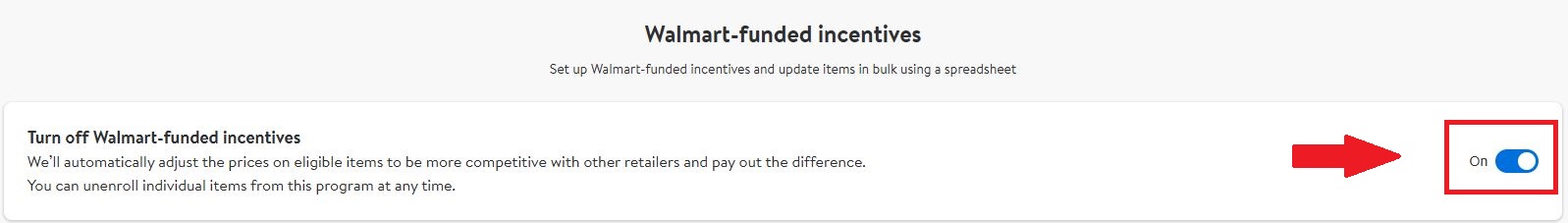

- Disabling the Incentives Program Completely

Go to Walmart Seller Center > Pricing > Incentives > Manage Incentives > Manage Walmart-funded incentives.

Locate the Disable Incentives Program button and turn it off.

After completing these steps, the changes may take some time to reflect in the system.